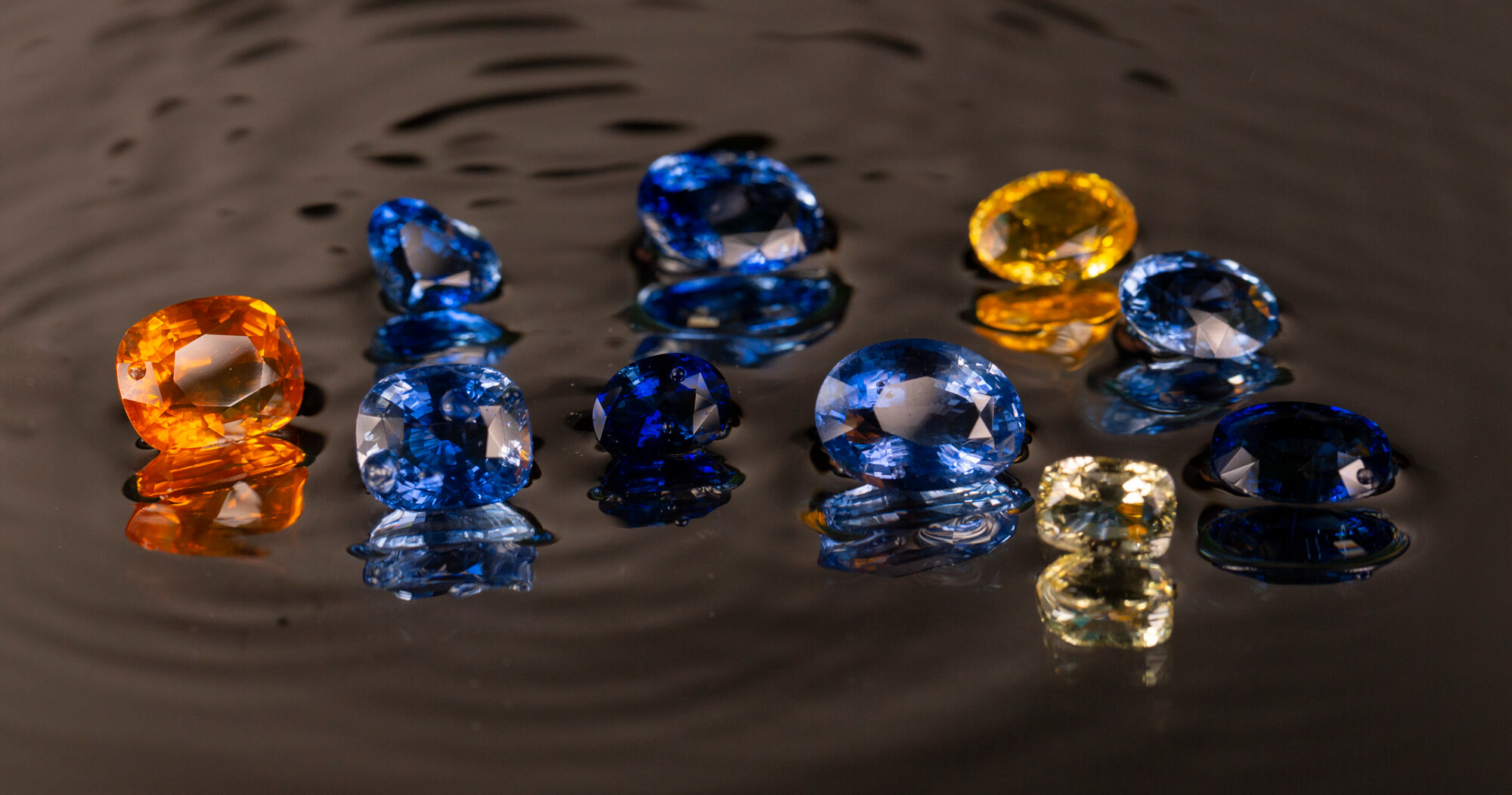

Investing in precious gemstones can be a rewarding venture for those intrigued by the allure of these timeless treasures. Whether you’re drawn to the beauty of sapphires, the fire of rubies, or the rarity of emeralds, understanding the basics of gemstone investment is crucial for making informed decisions. This guide will navigate you through the essential considerations and steps involved in the αγορα πολυτιμων λιθων.

Understanding the Appeal of Precious Gemstones

Precious gemstones have captivated humanity for centuries, not only for their aesthetic appeal but also for their enduring value. Unlike other commodities, gemstones combine beauty with scarcity, making them highly desirable for collectors and investors alike. Each gemstone possesses unique qualities that determine its worth, including color intensity, clarity, cut precision, and carat weight.

Factors to Consider Before Investing

Before diving into the purchase of precious stones, consider these key factors:

1. Education and Research

Begin by educating yourself about different types of gemstones, their grading systems (such as the 4Cs for diamonds), and market trends. Research reputable sources and consult with gemologists or experienced dealers to enhance your understanding.

2. Quality Over Quantity

In gemstone investing, quality reigns supreme. A smaller, high-quality gemstone can hold more value than a larger stone of inferior quality. Focus on acquiring gemstones with excellent color saturation, minimal inclusions, and superior craftsmanship.

3. Market Demand and Trends

Stay informed about market demand and trends. Certain gemstones may fluctuate in popularity and value due to fashion trends, cultural influences, or mining developments. Blue sapphires, for instance, have seen increased demand in recent years.

4. Authentication and Certification

Ensure your gemstones are accompanied by reputable certifications from recognized gemological laboratories. Certificates verify authenticity and provide details about the gemstone’s characteristics, enhancing its marketability and value.

5. Diversification and Risk Management

Like any investment, diversification is key to managing risk. Consider spreading your investments across different types of gemstones to mitigate market volatility and capitalize on varying demand trends.

Steps to Acquiring Precious Gemstones

6. Establishing Your Budget

Set a realistic budget based on your investment goals and financial capacity. Gemstones can range significantly in price, so clarity on your spending limits is crucial.

7. Building Relationships with Reputable Dealers

Forge relationships with established dealers known for their integrity and expertise. Trusted dealers can offer guidance, access to exclusive collections, and assurance of authenticity.

8. Storage and Insurance

Invest in secure storage options and consider obtaining insurance coverage for your gemstone collection. Proper storage preserves gemstone quality and protects your investment against loss or damage.

Conclusion

Investing in precious gemstones blends passion with financial opportunity, offering a tangible asset that transcends trends and retains its allure over time. By prioritizing education, quality, market awareness, and prudent decision-making, you can embark on a rewarding journey into the world of gemstone investment.